Closed Consultation

Removing barriers to switching regulators

13 July 2017

- The deadline for submission of responses was 14 July 2016.

- Download this consultation paper or read it below.

Next steps

- 1.

The SRA is the regulator of solicitors and law firms in England and Wales, protecting consumers and supporting the rule of law and the administration of justice. The SRA does this by overseeing all education and training requirements necessary to practise as a solicitor, licensing individuals and firms to practise, setting the standards of the profession and regulating and enforcing compliance against these standards.

- 2.

This consultation has been published in order to seek the views of our stakeholders – particularly:

- The solicitors and law firms we regulate

- Consumers

- Insurers

- Other regulators of legal services

- The Legal Services Board (LSB)

- Competition and Markets Authority

Purpose of this consultation

- 3.

We are proposing to amend our Professional Indemnity Insurance (PII) requirements to remove a significant barrier to firms who wish to leave SRA regulation to be regulated by another Approved Regulator1.

- 4.

At present, if a firm we regulate switches to another legal services regulator, it is treated as if the firm has ceased to practise. That leads to six years of run-off cover being triggered automatically under our minimum terms and conditions (MTC) of PII2. This happens even if the firm takes out replacement PII for its future business, which may also cover claims arising from client matters that it has concluded over the previous six years. The additional run-off premium that becomes payable is typically around three times the annual premium but will vary depending upon the facts of each case.

- 5.

The obligation to ensure run-off cover is in place in this situation is placed on the firm and the insurer through different mechanisms: the former through the SRA Indemnity Insurance Rules 2013, (the Rules) and the latter through the general framework we have put in place with insurers under the Participating Insurer’s Agreement (PIA). The PIA governs our relationship with all of the insurers to provide insurance that meets the MTC, including the provision of six years run-off cover. Although we have the power to waive the obligation on a firm to obtain run-off cover, where we are satisfied this is appropriate, this does not alter the obligation on insurers under the current PIA to provide run off cover. Our proposal for consultation seeks to remedy this and ensure that any such waiver is effective.

We propose to make a variation to the terms of our Participating Insurer’s Agreement (PIA) to allow the run-off cover requirement not to be activated where the firm is moving to another Approved Regulator.

- 6.

This change to the PIA, when combined with our power to waive the Rules to the extent that this removes the requirement in the MTC to provide run-off cover in relation to a firm, will allow a firm to switch to a new Approved Regulator without triggering the run-off cover provisions.

- 7.

The changes are intended to facilitate an open and liberal market by removing unnecessary restrictions and maintaining appropriate consumer protection, recognising that the PII arrangements of all Approved Regulators are subject to the oversight of the Legal Services Board.

Question 1

Do you agree that we should remove the obligation for run-off cover when a firm switches from the SRA to another Approved Regulator?

Background and analysis

- 8.

PII policies are written on a "claims made" basis rather than the "losses occurring" basis used in general insurance. This means that responsibility for paying a claim lies with the insurer at the time the claim arises, or circumstances which may give rise to a claim are notified, rather than with the insurer that was on cover when the alleged negligent act took place. If a firm ceases practice, then run-off cover can protect the firm, its owners and employees if any future claims are made against the closed firm, although we only require this to cover a six year period. The existence or otherwise of PII does not affect the right of the consumer to take action against the legal service provider, though the existence of the run-off cover will increase the opportunity of a recovery where the firm no longer exists or is insolvent.

- 9.

We have been asked to change the automatic run-off cover requirement both by firms wishing to move to another Approved Regulator, and by the Approved Regulator that they are wishing to move to.

- 10.

Having reviewed the requirements, we are sympathetic with these requests. It is clear that the cost of run-off cover is a barrier to switching, and therefore potentially creates a barrier to a firm seeking out the most appropriate regulator for their business. The underpinning legislation for legal services regulation in England and Wales allows lawyers and firms to choose to be authorised by any Approved Regulator, that has been designated by the LSB as suitable to regulate the reserved legal activities3 that firms wish to undertake.

- 11.

We are conscious of the risk that competition between regulators may indirectly lead to outcomes that are not in the public or consumer interest. That might happen, for example, if regulators were to reduce consumer protection or avoid disciplinary or enforcement action below an optimal level, simply to attract and retain a larger number of firms. However, the LSB approves each regulator's regulatory arrangements. Thus we can be confident that each regulator's arrangements, including their arrangements for PII, are appropriate.

- 12.

Once the firm switches regulator it will need to comply with the regulatory arrangements of its new regulator. We have considered whether we should test these against the MTC to ensure that we only waive the requirement for run off cover where the other Approved Regulator requires the firm to have comparable PII. The advantage of such an obligation is that it would ensure continuity of cover and equivalent protection for consumers.

- 13.

There is a risk that the arrangements of the new Approved Regulator will not require the switching firm to have PII cover for claims made after it starts to regulate the firm, and which arise out of client matters concluded before that date. A firm might, for example, take up insurance that is on a loss occurring basis rather than claims made, or more likely have a policy that covers on a claims made claims arising only after the firm commenced authorisation with the new regulator. Similarly, the new Approved Regulator may allow a lower level of PII cover or a less advantageous set of MTC. While this does not alter the liability of the firm, it can lead to less consumer protection for consumers if insurance that had been in place when they chose their lawyer, is not in place when they make a subsequent claim and they are not able to enforce against the firm directly.

- 14.

The risk that the level of protection will change exists even for a consumer of a firm that does not switch regulators. Many firms have cover higher than that required in the MTC but may subsequently reduce this. The MTC themselves change over time. Furthermore, run-off cover is only required for six years post cessation and some claims may arise later than this. However, that does not alter the fact that these proposals do carry some additional risk of lower consumer protection.

- 15.

A counter factor to this is that the cost of PII can be the trigger for some firms to close, or to struggle on, leading to a disorderly collapse with attendant intervention costs and adverse impacts on clients. The availability of a different regulator that has lower costs (directly or indirectly through lower PII requirements) may help a firm to reduce its costs and continue to trade. This is likely to be to the benefit of the clients of firm that switches regulator and consumers overall by avoiding regulatory costs that are ultimately borne by all consumers.

- 16.

Imposing an "equivalence" requirement brings both practical and conceptual challenges. Firstly, the role of considering the adequacy of the regulatory arrangements of other Approved Regulators is not for us, and has been given by statute to the LSB who will consider their PII requirements in the context of their wider regulatory framework. Once a firm has moved out of our jurisdiction and into the jurisdiction of another regulator, we do not – and should not – have any control over its continuing practice and ongoing insurance arrangements which means that, in essence, a firm’s ability to meet any conditions imposed through the waiver will be liable to change, and those conditions are unenforceable. However, the decision to waive is exercised on a case by case basis, taking into account the firm’s individual circumstances. Therefore we are able to look at the position at that point in time, including evidence of the firm’s future insurance arrangements and the nature of the risk it poses to clients, to decide whether or not it is appropriate in the circumstances to do so.

- 17.

We will also address some of the downside risks that arise from these proposals by inviting other Approved Regulators to ensure that their arrangements adequately consider the appropriate levels of consumer protection that apply when a firm switches, in particular cover for client matters concluded before the switch. The appropriateness of such arrangements will be for each Approved Regulator subject to the approval and oversight of the LSB.

- 18.

This proposal is made in the knowledge that we are planning a further consultation later in 2016 to consider a wider reform of our PII requirements. Any proposals that are made at that stage will be consistent with our Policy Statement on our approach to regulation, published in November 2015. We have considered if this proposal could be delayed until the wider reforms are consulted upon and implemented. We do not think that is a proportionate delay. Those reforms may be significant and thus warrant a much longer period for implementation. As a result, we consider that this proposal represents a proportionate and workable temporary solution to the issue.

- 19.

We have also considered our obligation4 to take reasonable steps to avoid regulatory conflict with the regimes of other Approved Regulators. Our proposal will help to reduce the potential for such conflict by avoiding our obligations having an effect once a firm is authorised by a different Approved Regulator.

- 20.

In this context we do not consider that there is sufficient justification to maintain the existing barrier to SRA firms choosing to move regulator if that works best for them and their clients.

PII relationships

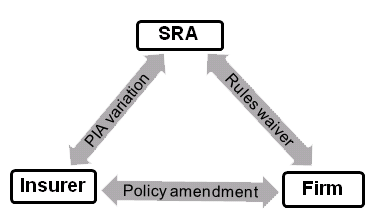

- 21.

There are three key parties involved in our PII arrangements. The bilateral relationships between them are as follows:

- SRA – Insurer relationship – this relationship is governed by the PIA. Under the terms of the contract where a firm switches regulator it becomes a "non-SRA firm" and the run-off provisions are automatically triggered. The insurer cannot avoid its obligation to provide six years run-off cover simply by way of an agreement with the firm, due to the existing provisions of the PIA which provides that the MTC prevail.

- SRA – Firm relationship – this relationship is governed by the SRA Indemnity Insurance Rules 2013. The Rules require that all firms we regulate must take out and maintain a policy of "qualifying insurance"5 which is a policy that complies with the MTC we specify. One of the MTC terms requires that the insurance policy must provide six years run-off cover in circumstances where a firm leaves SRA regulation6. This position can be changed by the granting of a waiver to the firm.

- Firm – Insurer relationship – this relationship is governed by the policy of qualifying insurance provided to the firm by the insurer and which must give full effect to the MTC including the provision of six years run-off cover in the event that an insured firm’s practice ceases as a consequence of switching regulator. This position can be changed by agreement between the insurer and the firm following a waiver of the MTC, so long as the insurer is relieved of its obligation to meet the MTC under the PIA.

- 22.

The three relationships are illustrated in Figure 1.

Figure 1 – Structure of compulsory PII arrangements for solicitors

Proposed variation of the PIA

- 23.

Where we consider it necessary we can vary the terms of the PIA during an Indemnity Period. The PIA provides that any such variation is effective from the date falling two months after such variation is notified in writing to each Participating Insurer. The PIA says that, so far as reasonably practicable, we shall present any proposed variation to the agreement to the Liaison Committee7 for consultation before giving notice of such variation.

- 24.

The proposed variations of clauses 2.2 and 5.5 of the PIA are set out in Annex 1 to this consultation paper. This wording allows any waiver of the MTC which remove the requirement to provide run off cover to take immediate effect.

Proposed waiver wording

- 25.

An example of waiver wording is also set out in Annex 1 to this consultation paper. The draft wording waives the SRA Indemnity Insurance Rules 2013 to the extent that this removes the requirement in clause 5.4 of the MTC to provide run-off cover in relation to the Firm. The exact wording of any waiver will vary on a case by case basis and take into account the context of the application and the grounds on which the decision is granted. If an insurer, with good reason, does not agree then the waiver is unlikely to be granted. This avoids the waiver mechanism being used by a firm to impose a change to its policy of insurance against the will of the insurer.

Question 2

If you have answered yes to Question 1, do you agree with our method for delivering this proposal?

Question 3

Do you have any further comments on our proposal or on the changes to the PIA or terms of the example waiver proposed?

Assessing impact

- 26.

The proposal is to remove unjustifiable regulatory restrictions. This will have a positive impact on firms that wish to exercise their right to switch regulator. A driver may be reduced regulatory costs (particularly in the area of insurance) that in the long run, in a competitive market should be passed on to consumers.

- 27.

As set out in paragraphs 10-13 above, there is a potentially negative impact on consumers that make a claim that would have been covered under SRA mandated run-off cover but is not covered under the insurance subsequently in place. We can be assured that the new Approved Regulator has met the statutory requirements to be approved, including having appropriate regulatory arrangements and those are subject to scrutiny by the LSB – the statutory oversight regulator. This is discussed fully in paragraphs 14-19 above.

- 28.

The proposed changes are intended to provide flexibility in circumstances where both a firm and its insurer are content for the automatic run-off cover to be waived.

- 29.

These proposals are, in our view, more likely to be of significance to smaller firms. This is because larger firms are likely to maintain PII cover significantly higher than that required by any Approved Regulator. The potential benefits in terms of flexibility and perhaps lower costs are therefore more likely to accrue to smaller firms.

Question 4

Do you have any views about our assessment of the impact of these changes and, are there any impacts, available data or evidence that we should consider when finalising our impact assessment?

Next steps and implementation timetable

- 30.

This formal consultation is open for twelve weeks, closing on: 14 July 2016. We have already discussed these proposals with insurers and given them notice that we are considering this change to the PIA. As well as insurers, we will discuss the proposals with other legal regulators, the Law Society during the course of this consultation period. We will also write to each of the other Approved Regulators to seek their views generally and on the specific issue set out in paragraph 14 above. The consultation is in line with our published Our approach to consultation.

- 31.

Our forward timetable is set out below.

Formal consultation on our proposals Formal consultation on our proposals Consideration by the SRA Board 13 September 2016 Give formal two months notice to insurers of variation to the PIA and seek LSB approval if necessary September 2016 Variation likely to come into effect 1 December 2016

Annex 1: Amendments to PIA and proposed waiver wording to waive the requirement for run-off cover under the MTC

PIA Amendments

(a) Amend clause 2.2 of the Participating Insurer’s Agreement by inserting the words " and clause 5.5 " after the words ‘clause 4.1’ in the second line.

(b) Insert new clause 5.5 as follows:

- 5.5 Notwithstanding clause 5.1, where the SRA has waived the SRA Indemnity Insurance Rules 2013 to the extent that this removes the requirement in clause 5.4 of the Minimum Terms to provide run-off cover in relation to a Firm, such waiver, shall be effective for the purposes of this Agreement from the effective date specified in the waiver. The Insurer shall, in relation to any Firm to whom the waiver is granted, allow such Firm to rely on the terms of the waiver in interpreting the terms of any Policy and, in particular, the Minimum Terms of any Policy, issued to such Firm by the Insurer.

Core waiver wording

With effect from [date ], the [SRA] hereby grants a waiver to [name of firm] of the requirements of the SRA Indemnity Insurance Rules 2013 and in particular, Rules 4.1 and 5.1, to the extent that such Rules, by virtue of the requirement for qualifying insurance contracts to comply with the MTC, require run-off cover pursuant to clause 5.4 of the MTC. The SRA grants this waiver because the [name of firm ] intends to become a non SRA firm authorised by another approved regulator and their Insurer is content with a variation to the firm's policy to this effect.

Consultation questions

1. Do you agree that we should remove the obligation for run-off cover when a firm switches from the SRA to another Approved Regulator?

2. If you have answered yes to Question 1, do you agree with our method for delivering this proposal?

3. Do you have any further comments on our proposal or on the changes to the PIA or terms of the core waiver proposed?

4. Do you have any views about our assessment of the impact of these changes and, are there any impacts, available data or evidence that we should consider in developing our impact assessment?

- See the definition in section 20 of the Legal Services Act 2007

- Clause 5.4 of Appendix 1 (MTC) to the SRA Indemnity Insurance Rules 2013 which says that " … an insured firm’s practice shall (without limitation) be regarded as ceasing if (and with effect from the date upon which) the insured firm becomes a non-SRA firm. A Non SRA firm is defined to be " a sole practitioner, partnership, LLP or company which is not authorised to practise by the SRA, and which is either: (i) authorised or capable of being authorised to practise by another approved regulator… "

- See the definitions in section 12 of the Legal Services Act 2007.

- Section 52 of the Legal Services Act 2007

- Rule 4.1 of the SRA indemnity Insurance Rules 2013

- Clause 5.4 of Appendix 1 (MTC) to the SRA indemnity Insurance Rules 2013

- The Liaison Committee is made up of representatives of the Participating Insurers and the SRA.