Statement

Financial penalties

Updated 30 May 2023 (First published 22 August 2022)

The overwhelming majority of solicitors do a good job and meet the high standards we all expect. But when things go wrong we can, and do, step in to make sure clients are properly protected. This includes powers to fine individuals and firms.

You can read more about our enforcement work in the dedicated section on our website, and we cover the detail annually through our Upholding Professional Standards report.

With effect from 20 July 2022, the Ministry of Justice increased our fining powers from £2,000 to up to £25,000 for 'traditional' firms and the solicitors who work in them.

Following two consultations and an application to the Legal Services Board, our new financial penalties regime has now come into force. The changes we have made will help us to resolve cases as quickly and effectively as possible, reducing stress and cost for all those involved, while maintaining proper safeguards.

We will continue to refer serious cases of misconduct to the Solicitors Disciplinary Tribunal (SDT). Only the SDT can suspend and strike off solicitors while it also has unlimited fining powers.

This statement sets out our processes and what we have changed.

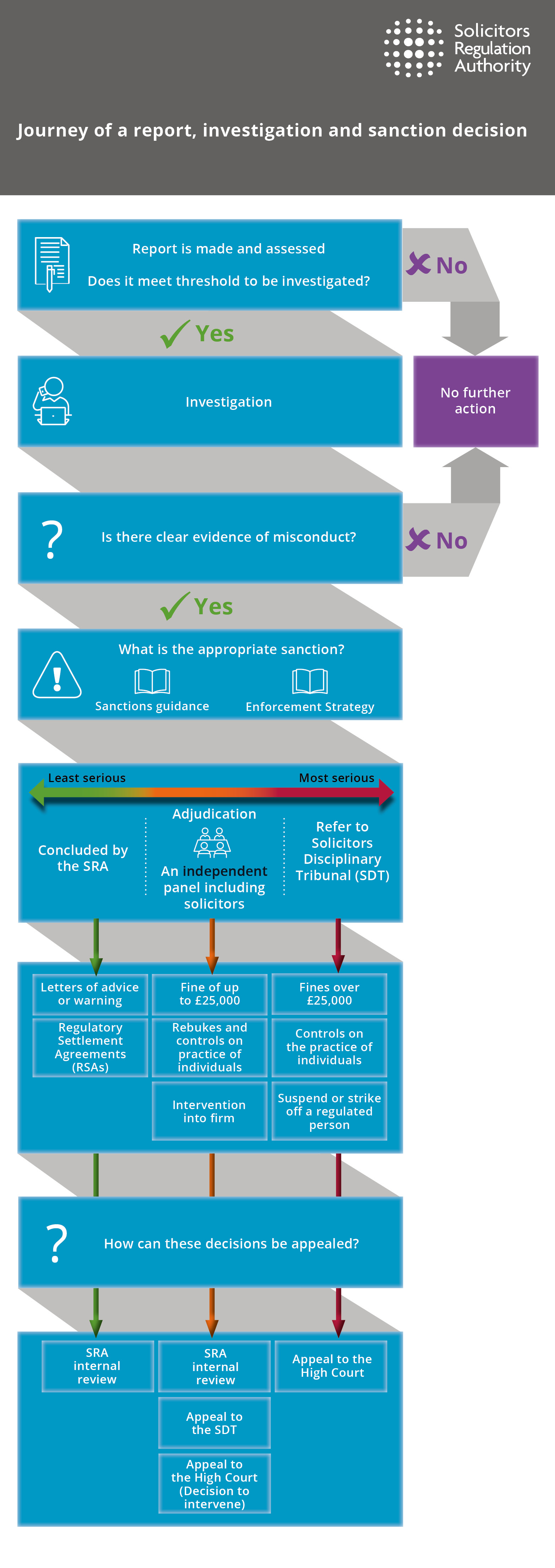

What happens when we receive a complaint?

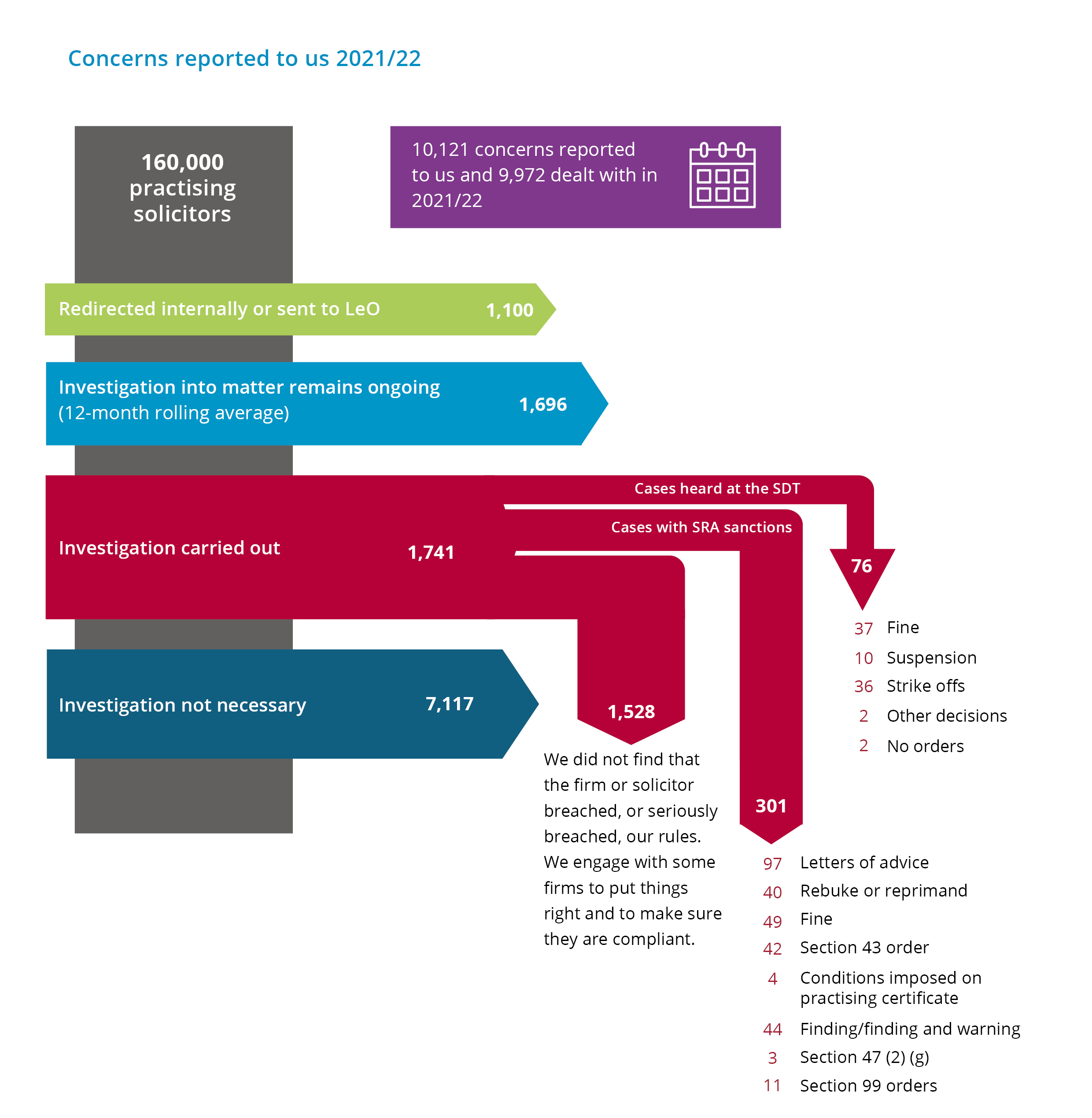

We receive more than 10,000 complaints a year about the firms and individuals we regulate - a small number relative to the overall scale of legal work and activity, with the consumer law market value estimated at around £22bn.

We assess each complaint and make a decision about whether we need to investigate. In 2021/22 we referred 1,741 matters for investigation.

We give everyone who is subject to an investigation early notification of the nature of the complaint made and the issues that we are investigating. At the end of an investigation, we give them the opportunity to make representations before any decision is taken - having seen a notice setting out the allegations, evidence and recommended action - and we consider any representations as part of our decision-making process.

The majority of concerns do not result in us taking enforcement action. In many cases we provide the solicitor or firm with advice, or do not find that there has been a breach of our rules at all.

When enforcement action and fines are necessary

2021/22 saw us impose 301 internal sanctions, of which 49 were fines. Our use of financial penalties is an important part of our enforcement work.

Our procedure for imposing internal fines and other regulatory sanctions, safeguards the independence of decision-makers by keeping separation between those who investigate and those who adjudicate on cases.

Fines are imposed by legally-qualified adjudicators, who are functionally separate from our operational teams, and are appointed to make objective and impartial decisions using our approach to financial penalties guidance. See who can make decisions at the SRA in our decision-making framework and in the graphic below.

For the most serious cases (falling within penalty band D in our guidance) the case will be heard before a panel of adjudicators. Panels generally have three members, and include at least one lay and one legally qualified member.

Fines can also be agreed through a regulatory settlement agreement (RSA) in which the respondent agrees the case against them, including the appropriate level of fine.

In 2021/22 we referred 76 cases of serious misconduct to the Solicitors Disciplinary Tribunal (SDT), which has unlimited fining powers.

Any fines levied by us or the SDT go to HM Treasury.

Open allWhat's changed? Enhancing our fining powers

We are committed to reviewing and improving our processes to make them as timely, streamlined, open and fair as we can.

As part of our work to improve what we do, we consulted on a range of proposals in relation to our fining powers, aiming to take steps that would help to resolve cases as quickly and effectively as possible while maintaining proper safeguards, reducing stress and cost for all those involved.

We carefully considered the responses to our consultation and have:

- Amended our guidance to make it clear that for any case involving sexual misconduct, discrimination or any form of harassment, a financial penalty will only be considered in exceptional circumstances.

- Amended our fining framework for firms and individuals so that we take into account, in all cases, the turnover of firms and income of individuals when setting levels of fines.

- Increased the maximum amount we will usually fine firms to 5% of annual domestic turnover.

- Introduced a schedule of fixed penalties for a small number of lower-level breaches of our rules of up to £1,500 to enable lesser issues to be dealt with more effectively and in a timely way. Fixed penalties will also provide greater transparency and consistency in how penalties for those lower-level issues are applied.

With effect from 20 July 2022, the Ministry of Justice increased our fining powers from £2,000 to up to £25,000 for 'traditional' firms and the solicitors who work in them. This does not impact on alternative business structures and the individuals working in them, for which we can already impose fines of up to £250m and £50m respectively. In the longer term, we would like to be aligned with the other legal regulators, whose fining powers are not limited.

The uplift in fining powers means that fewer cases now need to go to the SDT, an independent tribunal that is able to impose greater fines than we can, as well as to suspend solicitors and to strike them from the roll. Our increased internal fining levels are helping us to resolve cases more quickly, saving all concerned time, stress and costs.

Applying the new fining powers

Since July 2022 we have applied the increased fining powers to all cases where we consider a fine of up to £25,000 is appropriate.

Importantly, solicitors and firms can appeal any outcome or penalty we impose to the SDT.

We do, of course, retain the discretion to refer any case to the SDT, save for those relating to ABSs, for a full hearing, where we judge this to be more appropriate. This may be, for example, where there are more serious connected considerations, or the facts are disputed and cannot be resolved without oral evidence tested through a hearing process.

We have also worked jointly with the Solicitors Disciplinary Tribunal (SDT) to develop a shared understanding of the types of cases that would be referred to the SDT and those the SRA alone would deal with. We published a joint statement in January 2023.

Improving transparency in our decision making

The need to address the transparency and robustness of our processes – showing how we meet high standards and demonstrating a clear separation between those investigating and those determining the outcome and sanction – was raised with us and we agree. We have therefore taken rigorous steps to improve the openness and robustness of our procedures. We have:

- Clarified in our rules that all fines, apart from fixed penalties and agreed outcomes, can only be imposed by functionally separate adjudicators.

- Introduced new rules that specify that the most serious fines (those falling into Band D according to our published guidance) must be imposed by adjudication panels, rather than single adjudicators.

- Introduced rules to clarify that any review of a decision must be dealt with by a different decision-maker to the one who made the original decision.

- Streamlined our ability to revoke a referral we have made to the SDT that has not yet been certified.

- Set out rules to make the circumstances in which we can hold a hearing clear – limited to situations where we are unable to refer a matter to the SDT and a hearing is necessary to decide the case - and enable all adjudicators to direct that a hearing should take place.

- Made express provision in our rules that adjudicators or panels are able to interview respondents before making first-instance and review decisions.

- Started piloting the use of personal impact statements in cases relating to sexual misconduct, discrimination and harassment to ensure that the impact on victims is considered in a consistent and structured way.

- Updated guidance on our decision-making processes and procedures, to better demonstrate the existing functional separation and the independence of the adjudication function as well as the safeguards in place to ensure a fair and transparent process.

Improving how we publish information on the decisions we take

In 2022 we consulted on what information we publish about the disciplinary decisions we make The consultation asked for views on whether our current approach strikes the right balance between protecting the best interests of the public, while being fair and proportionate to the profession.

When we impose fines for individuals that considers their income, we will publish the fine level and the percentage of income taken into account. This is to ensure transparency, uphold public confidence and ensure our fines act as a credible deterrent. For firms, we will publish the fine level and the percentage of turnover taken into account.

We are currently redrafting our Publication of Regulatory Decisions guidance to implement changes agreed following the consultation. This provides information about the types of regulatory decisions we publish and for how long, to ensure that we are transparent and proportionate for the decisions we make.

Conclusion

Taken together, the steps we have set out above will make a major contribution to our commitment to improving our processes, making them as timely, streamlined, open and fair as possible.

We will continue to keep our processes under review and are planning formal evaluation of all the changes we have made. We will also be publishing additional detail on the fines we issue in our annual Upholding Professional Standards report, including on how we have used our increased fining powers.